Powering Success

Flexible funding solutions for UK businesses.

Powering Success

Flexible funding solutions for UK businesses.

Welcome to Independent Growth Finance (IGF)

We are a leading national provider of flexible Asset Based funding solutions to UK businesses.

Independently owned, we pride ourselves on delivering unrivalled levels of customer service, creating partnerships with our clients in a way that big banks simply can’t.

Our facilities unlock cash flow from company assets, providing funding for and often supporting event driven scenarios such as:

Growth, Acquisition, Refinance or Turnaround.

What We Do

IGF lends to clients in the SME/Lower Middle Market space, which for IGF means businesses with a turnover between £3m and £200m.

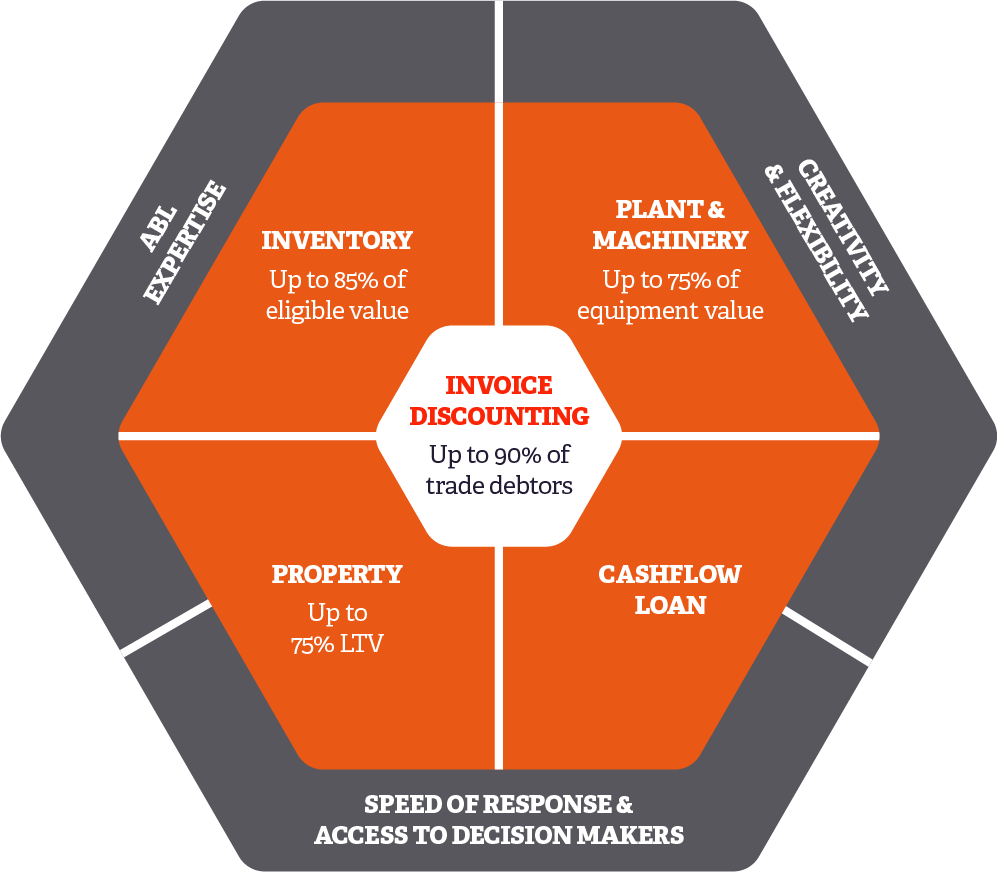

Our highly experienced ABL team are focused on generating the highest levels of funding for your business, unlocking the value tied up in your combined business assets.

Centred around the core asset of Trade Debtors, funding can also be leveraged against company assets such as Inventory, Plant & Machinery and Property.

We can also structure Cash Flow Loans, supporting profitable businesses with Mergers and Acquisition activity.

What we do

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce massa quam, porta vel erat gravida, sodales condimentum odio. Phasellus volutpat, libero at feugiat pharetra, ligula mi laoreet lorem, non dictum mi nisl quis sapien. Nunc auctor laoreet justo, ut tincidunt odio tincidunt eleifend. Mauris nec magna vitae lorem semper rhoncus.

Find out more

Who we work with

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Fusce massa quam, porta vel erat gravida, sodales condimentum odio. Phasellus volutpat, libero at feugiat pharetra, ligula mi laoreet lorem, non dictum mi nisl quis sapien. Nunc auctor laoreet justo, ut tincidunt odio tincidunt eleifend. Mauris nec magna vitae lorem semper rhoncus.

Find out more

What our clients say

-

We decided to partner with IGF because they took time to understand our business, and have significant appetite to support us, providing a flexible funding solution with sufficient headroom to accelerate the realisation of our goals. The beauty of using an alternative finance provider such as IGF, is that they are able to push the envelope in terms of facility size and covenant flexibility.

Nick Stern, CFO

-

We reached out to PwC to find a finance partner that supported our vision and would also grow with us. IGF was selected due to the favourable terms offered and a professional and enthusiastic team.

Mike Thompson, Managing Director

-

In IGF we saw a similarly entrepreneurial, pragmatic, and agile partner that fits perfectly with the direction of our business. The whole team at IGF has been superb and has moved at pace to complete the transaction, notwithstanding the challenges of the Covid-19 backdrop, and this will support our growth over the next five years.

Jonathan Marlow, Executive Director

-

We quickly realised IGF offered not only a solution and insightful advice, but relationships were at the core. They took the time to understand the full scope of our business and recognised the opportunity.

Richard Bradley, Chief Operating Officer

-

IGF got to know the company and the management team which has helped us achieve a great working relationship in a short space of time. They took the time to get to know the company’s challenges and aspirations and as a result we see this partnership continuing for many more years.

Kerrie Murray, CFO

Our key numbers

£500m+

Live Facility Limits

£3.2bn+

Total Client Turnover

We support UK-based companies with a turnover of £3M+ who need funding to grow. We will help you overcome cash flow challenges and secure exciting new opportunities through our flexible financing that grows as you grow.